- Transmission may improve in the coming months as the share of EBLR increases in banks’ portfolios.

- Also, liquidity has been progressively tightened in the past six months by the RBI.

The success of monetary policy depends on the effective transmission of policy repo rate changes to the interest rates in the economy.

- Simply put,the Reserve Bank of India (RBI) cannot influence the economy if the banks it regulates do not change their interest rates in tandem with the changes it makes to its repo rate.

- This transmission process is getting somewhat ineffective,again.

- The RBI hiked its repo rate by a cumulative 250 basis points between May 2022 and February 2023,pausing on hikes thereafter.

- Banks followed suit and have hiked their lending rates consequently.

- But the transmission has not been uniform across loan segments and has also not been complete.

Transmission has been swift on fresh loans, but poor on outstanding loans

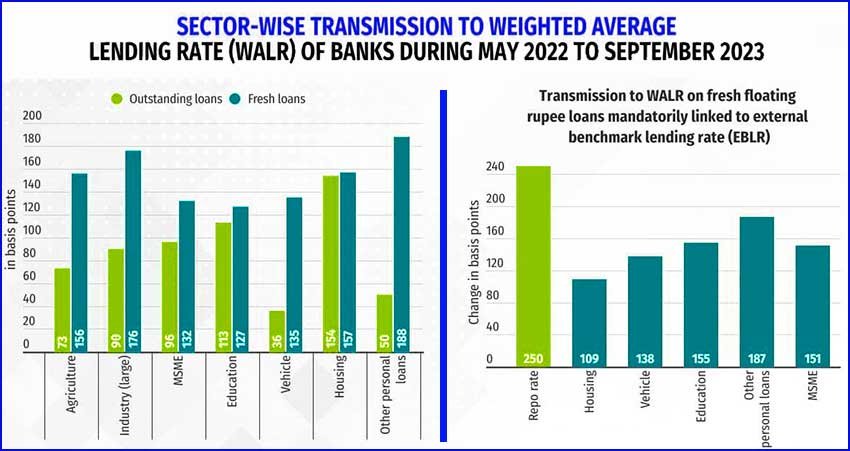

- Cast your eyes on the above charts.

- The first one shows that the transmission of policy rate hikes onto weighted average lending rate (WALR) has been swift if we see the fresh loans.

- However,on an outstanding basis,the transmission has been poor which indicates a large number of old loans are yet to be repriced.

Transmission has been varied across loan segments

- Within segments,the maximum transmission has been to unsecured personal loans and large corporate loans.

- At the same time,on an outstanding loan basis,unsecured personal loans and auto loans have shown the least transmission of policy rate hikes.

- Note that these loans were mandated to be priced off an external benchmark since October last year.

- Most banks adopted the repo rate as the external benchmark.

- Old loans are linked to marginal cost-based lending rate (MCLR) which is the cost of deposits of banks.

- Indeed,an RBI study shows that surplus liquidity and a higher share of low-cost deposits have limited hikes in the MCLR.

Transmission may improve in the coming months due to several factors

- Transmission may improve in the coming months as the share of EBLR increases in banks’ portfolios.

- Also,liquidity has been progressively tightened in the past six months by the RBI.

- Furthermore,the share of low-cost current and savings account deposits (CASA) in overall bank deposits has fallen sharply.

- All these factors will put pressure on lending rates.

Banks have been shrinking spreads over the repo rate to compensate for tenure and credit risk of the loans

- That said,a peculiar trend has emerged in the past few months.

- Banks have shrunk the spreads they charge over the repo rate to compensate for tenure and credit risk of the loans.

- The final lending rate to borrowers has,therefore,come down.

- As we explained in our November 22 piece,loan rates have eased despite a tight monetary policy because banks are aggressively chasing retail loans,especially unsecured.

Banks have been limited in their ability to transmit policy rates due to their chase for growth and their own cleaned up balance sheets

- In their chase for growth and lulled by their own cleaned up balance sheets along with the narrative of robust demand,banks have limited this transmission of policy rates onto lending rates.

- Since retail and small business loans are now mandated to be linked to an external benchmark rate which for most banks is the repo rate,lenders have shrunk their spreads that they charge over and above the external benchmark rate to keep the final lending rate for the borrower benign.

This is about to change as the RBI’s hike in risk weights of such loans will mean that banks have to reprice their loans to cover the cost of setting aside extra capital

- This is also about to change as the RBI’s hike in risk weights of such loans will mean that banks have to reprice their loans to cover the cost of setting aside extra capital.

In conclusion,

- The transmission of monetary policy is under threat again.

- Transmission has been swift on fresh loans,but poor on outstanding loans.

- Transmission has been varied across loan segments.

- Transmission may improve in the coming months due to several factors.

- Banks have been shrinking spreads over the repo rate to compensate for tenure and credit risk of the loans.

- Banks have been limited in their ability to transmit policy rates due to their chase for growth and their own cleaned up balance sheets.

- This is about to change as the RBI’s hike in risk weights of such loans will mean that banks have to reprice their loans to cover the cost of setting aside extra capital.